Post-Christmas is a great time to discover our new normal, now that we have new toys to play with - both kids and adults. So the girls have new legos, a new doll stroller, and a whole restaurant's worth of play food. I got an iPod touch and Caleb will be getting a smart phone.

In our precarious financial position, the holidays are the only time when we get silly electronic toys. I say silly since there's nothing I can do on the iPod that can't be done on the computer. Also silly because now I can carry around Facebook and angry birds, as if they need to be in my back pocket. I detest the idea of my girls being iThingy orphans, but have already caught myself ignoring them for the sake of whatever I happen to be doing online. Grr.

But what, you may ask, do Christmas gifts have to do with becoming debt free? We are not going to sell all these new toys for the sake of paying off our debt, though some in our situation might. While I do have an app for budgeting, that probably won't get us out of debt any sooner.

What will get us debt free is discipline. The iPod is an opportunity to practice this. I've already deleted Angry Birds and the only game apps I'll have are Fisher-Price. I'll need to keep myself from constantly checking Facebook and email, just like I keep myself from stopping at McDonalds when I'm out. Being in control of my sinful and selfish desires is key to living life as its meant to be lived.

Travelling the road from debt to the ultimate family vacation.

Friday, December 30, 2011

Temptation to quit

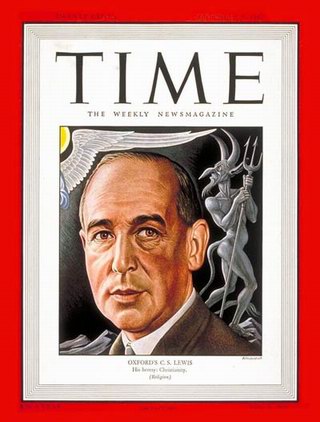

I was speaking with my father-in-law this morning about C.S. Lewis's "Space Trilogy." Books that I have read and re-read countless times and find something wonderful to explore each time. Truly, one of the finest literary works of the 20th century. Gushing aside, there is a message that permeates each book in remarkable ways: the temptation to quit comes when we are most determined to finish. Here are some examples:

In Out of the Silent Planet Ransom (our kidnapped, space marooned hero) experiences heartache when, rather than go quickly to see Eldil on Malcandra. He and the creature who have adopted him go on a hunting trip first. In the process his friend is killed and the creatures realize that he should have gone to see Eldil right away. Lesson: distractions can be fatal.

In Perelandra Ransom (now exploring Venus) has summoned the story's narrator to his house before the scheduled interstellar excursion set for him by a visiting Eldil. While the narrator (Lewis himself) is walking between the train station and Ransom's house, he is beset with any number of fears and temptations that cause him to nearly flee in terror back to his own home. The lesson: when setting out on the virtuous path, the temptation to give up early will be overwhelming.

The temptation to quit is pervasive these days. So easy to just give up the ghost and let things slide. I have thought more than once that the dreams we have for our family and our future are nothing but smoke in the wind. I have grasped at straws. I have been let down time and time again. The temptation to circle the wagons, protect ourselves, avoid the dangers, avoid the heartache is sometimes more than I can handle. To be honest, I would love to just give up. It would be so easy to just go back to the way things were.

Why don't we just quit? Why not listen to the voices that are surrounding us? Because we believe that we can reach this goal. We want a better life for us and for our girls. We are tired of insecurity. We are fed up with foolishness. The cycle ends now....or at least is now coming to a close. No excuse will be good enough: only results.

In Out of the Silent Planet Ransom (our kidnapped, space marooned hero) experiences heartache when, rather than go quickly to see Eldil on Malcandra. He and the creature who have adopted him go on a hunting trip first. In the process his friend is killed and the creatures realize that he should have gone to see Eldil right away. Lesson: distractions can be fatal.

In Perelandra Ransom (now exploring Venus) has summoned the story's narrator to his house before the scheduled interstellar excursion set for him by a visiting Eldil. While the narrator (Lewis himself) is walking between the train station and Ransom's house, he is beset with any number of fears and temptations that cause him to nearly flee in terror back to his own home. The lesson: when setting out on the virtuous path, the temptation to give up early will be overwhelming.

The temptation to quit is pervasive these days. So easy to just give up the ghost and let things slide. I have thought more than once that the dreams we have for our family and our future are nothing but smoke in the wind. I have grasped at straws. I have been let down time and time again. The temptation to circle the wagons, protect ourselves, avoid the dangers, avoid the heartache is sometimes more than I can handle. To be honest, I would love to just give up. It would be so easy to just go back to the way things were.

Why don't we just quit? Why not listen to the voices that are surrounding us? Because we believe that we can reach this goal. We want a better life for us and for our girls. We are tired of insecurity. We are fed up with foolishness. The cycle ends now....or at least is now coming to a close. No excuse will be good enough: only results.

Thursday, December 29, 2011

Goal setting for the new year

The moral of the story is not the tortoise was faster than the hare. Clearly, the hare could have beaten the pokey tortoise if he had focused on the goal and not stopped to nap in the clover. What is clear from the story, however, is that the tortoise was able to win because he never let himself believe that it was impossible. Even when the hare left him in the dust, he still believed that the desired goal was achievable--so long as he didn't stop moving towards the finish line. This year, we have set several goals to be accomplished over the next twelve months. Some of these may take only a few weeks, some a few months, others the whole year. You can follow our progress here on this blog, and join us by creating a Finish List and following #FinishYear on Twitter.

Below are Caleb's goals for 2012:

I'm going to read 12 non-fiction books and 12 fiction books (no more than two books per month) for the year 2012

I'm going to help my wife follow her dream and start a small business

I'm going to finish writing my novel

I'm going to start memorizing the book of Psalms

I'm going to make it to the 12 Great Feasts

I'm going to finish my Church History and Christocentricity of the Old Testament curricula

Below are Caleb's goals for 2012:

I'm going to read 12 non-fiction books and 12 fiction books (no more than two books per month) for the year 2012

I'm going to help my wife follow her dream and start a small business

I'm going to finish writing my novel

I'm going to start memorizing the book of Psalms

I'm going to make it to the 12 Great Feasts

I'm going to finish my Church History and Christocentricity of the Old Testament curricula

Tuesday, December 27, 2011

Christmas Letter

This is the first year that we've the opportunity to write a Christmas Letter. This is a tradition in my family, so I felt compelled to write out all our accomplishments for the year and to send it to various friends and family members (in limited quantities, our postage and ink budget was not as generous as I'd like).

For those who don't have a hard copy, here's our year in review.

For those who don't have a hard copy, here's our year in review.

December

2011

Dear

Friends and Family,

In

January of this year, we set ourselves an ambitious goal: to complete

the calendar year without any major life changes. We are happy to

report that during 2011 we have not moved, have had no births, and no

changes in employment status – a first for our family. However, we

have made some important changes.

First

is a renewed commitment to becoming debt free. We began following

Dave Ramsey's baby steps to financial peace in 2008, but haven't

really been able to make headway until this year, due to

unemployment. So far we have paid off Caleb's car, bought a used one

for Emily with cash, and are beginning to make a dent in the student

loan mountain. To motivate ourselves, we are planning a HUGE road

trip for the summer after we get out of debt, hopefully 2014. You

can follow our progress on the blog we set up:

debtfreeroadtrip.blogger.com

Secondly,

we are extremely excited to make joining the Eastern Orthodox Church

our first act of 2012. On January 1, Z will be baptized and the

rest of us will be confirmed, or chrismated as the Orthodox say, at

New Skete Monastery, which is just down the road. We covet your

prayers as we embark on this new journey of faith.

Turning

now to our personal accomplishments this year:

Caleb

has found great joy in his teaching position at Augustine Classical Academy. For 2011-'12 he has a very full course

load, including three levels of Latin, Theology, Church History, and

Drama. His students are currently: translating Virgil and Dr.

Seuss's The Grinch Who Stole Christmas;

wrestling with Augustine's Confessions;

debating early Christian heresies; and rehearsing “A Winter's Tale”

for performance in March.

Emily

spends her days running after A and Z, as well as running

around with them. Most weeks, they enjoy Story Hour at the library and MOPS (Mothers Of Pre-Schoolers). Fridays the

girls play at a neighbor's while Emily has some adult-time

volunteering at the Food Co-op. This fall, she has also

enjoyed the challenge of creative cooking with a weekly basket from

our CSA (community supported agriculture), True Love Farms in NorthBennington, VT. Some of our favorite meals have been Kale

Enchiladas, and Potato, Leek, Carrot and Celeriac Soup.

A,

2 ½, is growing into a responsible, inquisitive and creative big

girl. She enjoys painting, singing, playing pretend, reading and

cooking. She frequently declares her love for various objects and

people, and is always willing to give hugs, snuggles and kisses. Her

cute phrases and adorable actions are too many to mention, but here

are a few highlights: “reading” the insides of a sandwich; saying

“untundle” instead of “untangle”; switching personae by

declaring “I'm Sister Bear” or “I'm Anya”.

Z,

16 months, is sweet, loving and quickly becoming a natural

comedienne. Flashing her dimples, she says “cheese” eagerly for

every camera, and happily dons any object she can while declaring

“Hat!”

We

look forward to next year and all the excitement it might bring!

Hoping

you are well,

The

Shoemakers

Sunday, December 18, 2011

Never seen the righteous forsaken

...or their children begging bread (Ps. 37.25)

This year we were the recipient of a Christmas basket provided by the Elks in Greenwich, NY. We had no idea how we got on their list, but we received the call on Wednesday and the "basket" this afternoon. We got a 12lb. turkey, rolls, vegetables, apple sauce, milk, eggs, butter, potatoes, pasta, sauce, and more! It was so much more than we were expecting! God has been so good to us, and it's becoming very clear every day how much we need Him to reach our goals.

We are down to $150 in our emergency fund, behind on a couple of bills, and trying to wrestle our way through the NYS health insurance maze. This was one more example of the way His provision is always exactly the right amount at the right time. Here are some pictures!

This year we were the recipient of a Christmas basket provided by the Elks in Greenwich, NY. We had no idea how we got on their list, but we received the call on Wednesday and the "basket" this afternoon. We got a 12lb. turkey, rolls, vegetables, apple sauce, milk, eggs, butter, potatoes, pasta, sauce, and more! It was so much more than we were expecting! God has been so good to us, and it's becoming very clear every day how much we need Him to reach our goals.

We are down to $150 in our emergency fund, behind on a couple of bills, and trying to wrestle our way through the NYS health insurance maze. This was one more example of the way His provision is always exactly the right amount at the right time. Here are some pictures!

Sunday, October 30, 2011

Who gets paid?

As we've learned how to control our money, we've also been learning a lot of about our life's priorities and budgetary decision. One of the big questions we have had to ask ourselves is: Who gets paid? Every month we allot our paycheck across the four/five weeks of the month as to what bill gets paid when; but what about the deeper question of who gets paid over the long haul of our lives? We pay for insurance because there's no certainty about tomorrow or the day after. We spend money on preventative maintenance for our cars so that they run safely and reliably. There are other areas of money spent that fill this category: paying now to protect the future. Lately, we've been asking this question about our food choices. Do we spend the money on food or doctor's bills?

For us, this decision is easy: spend the money on food that is healthy, local, and organic now rather than exorbitant doctor's bills later on. The connections between poor diet and chronic illness are too clear to ignore, and we are making the choice for a healthier lifestyle that will be less expensive when seen over the course of our lives. We have made the choice to say "no" to processed foods and dollar menu specials, and "yes" to healthy, nutritious foods purchased at the local co-op, our CSA, and locally raised meats.

A lot of people struggle to make ends meet, and many of them (including us) have ended up on government assistance. As a result, it's very easy to spend your assistance monies on foods which will ultimately harm you. It takes discipline and wisdom to use WIC and SNAP to your health advantage. The biggest weapon in our arsenal has been the sinking fund: setting aside money a little bit at a time to make these large-sum payments for better foods.

For us, this decision is easy: spend the money on food that is healthy, local, and organic now rather than exorbitant doctor's bills later on. The connections between poor diet and chronic illness are too clear to ignore, and we are making the choice for a healthier lifestyle that will be less expensive when seen over the course of our lives. We have made the choice to say "no" to processed foods and dollar menu specials, and "yes" to healthy, nutritious foods purchased at the local co-op, our CSA, and locally raised meats.

A lot of people struggle to make ends meet, and many of them (including us) have ended up on government assistance. As a result, it's very easy to spend your assistance monies on foods which will ultimately harm you. It takes discipline and wisdom to use WIC and SNAP to your health advantage. The biggest weapon in our arsenal has been the sinking fund: setting aside money a little bit at a time to make these large-sum payments for better foods.

- We joined our local co-op, at which Emily volunteers each week to receive a 22% discount.

- We set aside money to pay for a winter CSA (Community Supported Agriculture) for 9 weeks of fresh vegetables plus two root/preserve pick-ups in January and February.

- We have put aside money for either a side of pork or a quarter of beef from one of two farms down the road

- We set aside very little money for "eating out" each month, and when we do it's usually local, small, and inexpensive.

For us the choice was easy: pay for a healthier lifestyle rather than pay the piper later on.

Thursday, October 13, 2011

Looking back on eating local part 2: a book review

Our first movement into becoming "locavores" was to brush up on the philosophy and thinking of the movement. Growing up in mostly rural areas, Caleb was used to the idea of finding the local farm stand and/or natural foods stores to do the majority of important shopping. Living in the city had turned us from what would have been a natural habit: eating local into the average suburban eater--no clear direction, buy what's on sale, don't pay attention to origin or season. We knew the shift back to thinking about localized food sources would be harder than just putting "local" in front of everything on our shopping list. Why were these things so important? What was so wrong with eating strawberries from California, tomatoes from Mexico, and corn from God-knows-where as long as we did the shopping at the local grocery store chain?

For inspiration and motivation we turned to Michael Pollan's In Defense of Food: An Eater's Manifesto, published by Penguin. This book has been life changing for our family; here are a few of the reasons why:

Pollan's premise is simple: Eat food; not too much; mostly vegetables. It seems simple, but once you start to unpack each of those things, you begin to see how difficult the solution to the problem has become over the last seventy years. With the advent of nutritionism, eating food has been harder and harder for the average person. Food science has taken hold of our national consciousness, and you can't even go to the grocery store without being bombarded by messages from the shelves about the supposed health benefits of the products contained.

We found this book to be incredibly challenging and exciting as we worked our way through it. Since that time, we have been more aware of the things we are spending (or not spending) our money on. We joined our winter CSA as a way to eat better and ensure that we got our money's worth on food in a way that we never were able to when we were making things up as we go along. It's done wonders for our health, quality of life, and budget.

For inspiration and motivation we turned to Michael Pollan's In Defense of Food: An Eater's Manifesto, published by Penguin. This book has been life changing for our family; here are a few of the reasons why:

Pollan's premise is simple: Eat food; not too much; mostly vegetables. It seems simple, but once you start to unpack each of those things, you begin to see how difficult the solution to the problem has become over the last seventy years. With the advent of nutritionism, eating food has been harder and harder for the average person. Food science has taken hold of our national consciousness, and you can't even go to the grocery store without being bombarded by messages from the shelves about the supposed health benefits of the products contained.

We found this book to be incredibly challenging and exciting as we worked our way through it. Since that time, we have been more aware of the things we are spending (or not spending) our money on. We joined our winter CSA as a way to eat better and ensure that we got our money's worth on food in a way that we never were able to when we were making things up as we go along. It's done wonders for our health, quality of life, and budget.

Wednesday, October 12, 2011

Crazy Couponing is Not For Me

I have a love-hate relationship with coupons. When we first started working our budget, I got all excited about them and immediately began clipping, collecting, sorting, and organizing. It didn't take me long to realize the dark, dirty truth about coupons. Well, maybe not that dramatic but I did discover a few things which turned me off from being a truly Crazy Coupon-er.

When using coupons, don't:

- buy more than necessary.

- buy unnecessary items.

- buy more unhealthy foods.

- buy more expensive brand names.

It is possible to go off the conspiracy theory deep end when discussing coupons and the companies behind them, but I try not to go that far. I do use coupons. A lot. I have an accordion organizer that I carry around with me. I am that lady standing in the middle of the aisle doing long division on the newspaper insert trying to figure out which Raisin Bran is cheaper per ounce. I am every cashier's worst nightmare. But I fall into these traps to some extent every time I shop.

In summary, when used wisely and carefully, coupons can save loads of money. The key is to make your own list, don't let the circulars and their discounts write it for you. Use coupons only on items you already buy in manageable quantities when you actually need them, and don't go crazy.

When using coupons, don't:

There are two ways that a coupon can cause a shopping cart to fill too quickly. The first is that many coupons require one to purchase 2 or 3 of a given item in order to get a discount. While some may see buying four gallons of ice cream to save a dollar as "stocking up", I see it as a waste. Certainly, some items may be "stocked" at home (anything without an expiration date), but this mentality easily becomes a justification for buying too many at once.

The second way is by buying tag-along items which are not on sale. For example, using a coupon for hot dog buns and then getting hot dogs as well. This is especially true for "Free" coupons which require the purchase of another item. Getting a free 2-liter of Coke is nice, but not when you must buy ten dollars worth of cookies and chips to get it.

I'm all for saving a dollar, but buying an item simply because a coupon sits before you is not a good strategy for saving money. I have taking to not clipping coupons for items that we generally do not buy to eliminate the temptation to "save money" on an item which will spend eternity in a cupboard.

For the most part, whole and unprocessed foods do not have coupons. The reason is simple: coupons are produced by the large companies which produce processed foods, not by farmers. Coupons are designed to be used at large-scale, box-store grocery chains, not the farmers market. This can lead one to spend a greater portion of the grocery budget on "cheaper" (i.e. discounted) foods, instead of those that are more nourishing and, simply, better.

I tend not to clip coupons for foods I don't want to end up buying. In our case, this includes microwave foods, anything with an unsightly amount of packaging, most things containing high fructose corn syrup, and anything with an ingredient list that's more than an inch long. We aren't exclusive and we aren't paranoid (you will find Cheez-its in our pantry and Pepsi Throwback in our fridge), but I also don't want our diet to drift too much into that world.

As I mentioned above, coupons are put out by the large multi-national corporations which produce so much of our daily needs and everyone of those needs has a name, and a brand. With the notable exception of Store coupons, generic brands do not generate coupons and, more often than not, are not on Sale. Even with a coupon, brands are often still more expensive than generics; be sure to check. This marketing at it's finest - companies know that you will pay more for their name brand simply because you have a coupon in hand and/or there's a little yellow Sale tag, even though the generic sitting right there is still $2 less, and has the exact same ingredients!

In summary, when used wisely and carefully, coupons can save loads of money. The key is to make your own list, don't let the circulars and their discounts write it for you. Use coupons only on items you already buy in manageable quantities when you actually need them, and don't go crazy.

Friday, October 7, 2011

Looking back on local eating: part 1

The plan had been to blog our way through the month of September talking about becoming locavores. As it turned out, September is a really hard month to blog through when you're working and parenting full-time, struggling to pay your bills, and making plans for the future. Add to that the fun we had experimenting with being local consumers, and you've got a month of adventure and zero free time with which to blog about a runny nose. This, now, is our attempt to blog about our trials and triumphs in being locavores for a month, and the way that it has changed our lives forever.

It turns out that a 250 mile radius from our little village covers a good portion of New York, Massachusetts, Vermont, New Hampshire, Maine, and a tiny sliver of Canada and Pennsylvania. I wouldn't say we struggled to remain local, though sometimes we forgot and splurged on something silly like bananas (the only thing our one year old would eat for breakfast for a while). Still, I would say that our menu was able to be incredibly varied including locally raised beef and turkey, produce, honey and maple syrup, and a delicious box of wine that lasted us for the entire month! Supplementing what we already do with new experiences, made this a big success; and it has forever changed the way we eat and think about food.

Things we already do:

It turns out that a 250 mile radius from our little village covers a good portion of New York, Massachusetts, Vermont, New Hampshire, Maine, and a tiny sliver of Canada and Pennsylvania. I wouldn't say we struggled to remain local, though sometimes we forgot and splurged on something silly like bananas (the only thing our one year old would eat for breakfast for a while). Still, I would say that our menu was able to be incredibly varied including locally raised beef and turkey, produce, honey and maple syrup, and a delicious box of wine that lasted us for the entire month! Supplementing what we already do with new experiences, made this a big success; and it has forever changed the way we eat and think about food.

Things we already do:

- make our own yogurt

- compost our kitchen scraps

- members of our local co-op

- shop road side garden stands and farmers' market(s)

- buy locally raised beef and other meats

- shop local bakeries

Things we added to our regular food routine:

- reading books and articles about food production

- watching films about food business

- processing apples and other produce to freeze and use later

- joined One Million Against Monsanto

- joined a winter CSA (saving for a summer CSA)

- Grew our own pumpkin (accidentally..it just grew in our compost pile)

- wrote letters to our Senators and Representatives re food issues

- enjoyed a box of local wine for the entire month

Wednesday, October 5, 2011

Paper Towels are Groceries Too

Being on a tight budget is hard. Really hard. It's stressful to squeeze every dollar till it screams, and pinch every penny and cut every coupon. It takes work to stay on top of all the envelopes and keep in mind that this $10 is to buy bread, eggs and milk when I suddenly realize that we're out of butter too and, wouldn't it be nice to have some cream cheese on hand, since it's on sale and I have a coupon.

Since most of the household buying decisions are made by me as Mom, I find myself under increasing pressure to make do with as little as possible so that money can be freed up to go towards our debt. I deal with this by lumping a lot of things under the heading of "groceries".

Our budget form has many different categories, but I roll everything for the household, from Toiletries to Cleaning Supplies, into Groceries (mostly because we buy so many things at the same store, whether it be Walmart, Dollar General or IGA, and I don't want to stand in line at the check-out pulling $5 from one envelope and $20 from another while also balancing coupons and toddlers).

Ergo, the Grocery envelope is my All-purpose envelope. Flour, coffee and dish detergent from the co-op - Grocery. McDonalds coffee - Grocery. Diapers - Grocery. Infant tylenol and cough drops - Grocery. Huge shopping trip to Price Chopper for 6 months worth of bread and toilet paper - you guessed it, Grocery.

All of this picking at the Grocery category throughout the month often ends up with me having two things: 1) an empty envelope when we're out of something important (like milk) and 2) incredible amounts of guilt for that $1 coffee or for paying $1.29 a pound for the Organic rolled oats or any number of other decisions made throughout the month that were justifiable at the time.

What to do? I'm attempting to be easier on myself. I know that, while not beneficial, going over budget by a gallon of milk or a roll of toilet paper is not going to kill anything. Also, I, frequently, remind myself that there are some things in life which are more important than keeping the budget balanced (like my sanity, for one, and feeding my children, for another). In future months this may lead to increasing of our grocery budget (gasp!) to prevent the completely-empty-envelope-and-refrigerator phenomenon.

Every month, we find ourselves walking the line between appropriate dollar stretching and being overly optimistic about how little it takes to adequately feed and clothe ourselves. Just to make things more exciting, every month that line seems to be in a different place.

(Btw, our budget meetings don't actually look like that cartoon. But it did make me laugh, so I thought I'd share.)

Wednesday, September 7, 2011

Locavore Challenge Days 3-7

This week has been crazy! Caleb started working at Augustine Classical Academy for the upcoming school year (first day was yesterday) Emily went to the Farmer's Market here in town for the first time this fall with our WIC checks, and we sent in a check to start our winter CSA! This may be a post full of exclamation points as I try to unpack all of the fun we've been having during this year's Locavore Challenge.

As you know we started with a day full of locally (within 250 mile) sourced foods. We also spent time on Day 2 going to roadside stands picking up squash, garlic, and whatever else local gardeners/farmers were selling out of their trolleys (it's an upstate NY thing, but I hope other places do this, too). Emily came back from the Farmer's Market with a huge haul of fresh vegetables and herbs. Take a look at the amazing produce she came home with: squash, herbs, carrots, celery, bell peppers, and green tomatoes.

This is our whirlwind tour of the last week of our locavore challenge. Coming up we'll be reviewing Michael Pollan's In Defense of Food!

While Caleb was at work on Tuesday, Ana (the 2 year old) and Emily used the Pretend Soup cookbook to make Green Spaghetti (pasta with pesto) for lunch.

Caleb cooked up pasta sauce from our neighbor's garden, and Emily added fresh parsley and oregano and squash tonight for our delicious dinner

Saturday, September 3, 2011

Eating from our neighbors' gardens

I love this time of year. Gardens everywhere are exploding with squash and tomatoes, so much so that even the most avid canners and preservers have trouble keeping up. Suddenly, little road side stands are everywhere. "Squash and Zucchini $1" "Homegrown Garlic" "Free Tomatoes"

Have extra produce? I am ever so happy to help you out.

Just this past week we: relieved our local co-op of an abundance of turning pattypan and baby crookneck squash, picked tomatoes from a friend's garden while they were out of town (with permission, of course); bought three 3 lb yellow squash at a roadside, drop-your-money-in-the-bucket stand; and got some "homegrown garlic" from a farm shed.

I have been making many bakes, casseroles and sauces with all of this goodness. I even made zucchini brownies. Some of it we've eaten already, but most went into the freezer. I'm well aware that the school year starts on Tuesday and busy weeknights with no time to cook will fast be upon us. Best to be prepared and keep Chinese and McDonald's at bay.

Have extra produce? I am ever so happy to help you out.

Just this past week we: relieved our local co-op of an abundance of turning pattypan and baby crookneck squash, picked tomatoes from a friend's garden while they were out of town (with permission, of course); bought three 3 lb yellow squash at a roadside, drop-your-money-in-the-bucket stand; and got some "homegrown garlic" from a farm shed.

I have been making many bakes, casseroles and sauces with all of this goodness. I even made zucchini brownies. Some of it we've eaten already, but most went into the freezer. I'm well aware that the school year starts on Tuesday and busy weeknights with no time to cook will fast be upon us. Best to be prepared and keep Chinese and McDonald's at bay.

How to Budget: Step 3

At long last, Step 3 of our 5. Believe me, it is much easier to do these steps than to write about them. Probably even easier to do them than to read about them.

- Determine income and pay periods for the month

- Name your Income

- Make it balance

- Allocate your expenses for each week

- Prioritize Irregular Income

Ah, math. If you don't already have a nice sharp pencil and good eraser handy, grab one. You'll need it. (A blackboard would work too, of course.) A calculator might be helpful too, if your arithmetic is rusty. I promise that there will be no algebra or calculus in this step. All we need to do is add up all the expenses and make it equal the total income.

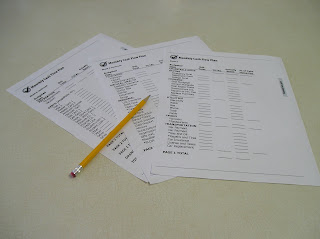

You'll also need a plan. We use Dave Ramsey's Monthly Cash Flow Plan (find it here), so I'll be walking you through it. If you don't want to fill it out, you can always use a legal pad.

I find it helpful to start at the end. On the third page of the Cash Flow Plan (CFP, from now on) at the very bottom is a line in bold that reads "Total Monthly Income". You should have figured this out in Step 1, so go ahead and fill it in. Below that line is the word ZERO. This is the goal. In the budget world, balance equals Zero.

Now, back to the beginning. Pull out the list of expenses that you made in Step 2. Draw a line at where your income ended. On our example sheet below (which is a simplification of our actual budget), this line comes after Caleb's Sallie Mae payment, but before mine.

Now, as much as we'd like to tell Sallie to stuff it, it is a better idea to take a look in category 4 and see if there's anything that can be cut. Looks like we wont be saving to go to Ohio this month. :(

Voila, Ohio is gone, our math is adjusted and now we can move on to our CFP. (See how messy things get when you use pen?)

If you're having trouble with this step because there's just too much debt, you'll want to use the pro rata plan. Dave gives the basics here and here. This is a more in depth look. If you're this much underwater though, you'll want to get more help than we can offer here.

The CFP has many categories and subcategories for you to fill in. Use your list as a guide and make any changes to the form that you might need. You'll notice that is in basically the same order (Giving, Savings, 4 walls, etc.) as your list. Fill in each item's cost in the Sub Total column. At the end of each category, add up everything and put the total in the Total column. At the end of each page, add up all your totals for the Page Total.

If you're feeling particularly ambitious, or if addition just isn't enough to satisfy, divide the total for each category by your total income and fill in the % of Take Home Pay column on the far right. This can be very useful if you've never budgeted before to see what areas are eating most of your income and might give you ideas for where to trim your lifestyle.

At the end of the month, you'll fill in the Actually Spent column (assuming you kept track of such things, which you should so that you can fill this in). This will help you assess where changes need to be made so that you can make a better budget next month. It takes a few months (3-6) to really get the hang of it.

At the end of the month, you'll fill in the Actually Spent column (assuming you kept track of such things, which you should so that you can fill this in). This will help you assess where changes need to be made so that you can make a better budget next month. It takes a few months (3-6) to really get the hang of it.

Continue to fill in and add up categories through the whole sheet. One nice thing about the CFP is all those categories because they'll help you think about all the things you might need to buy in a given month. The trick to budgeting is planning ahead as much as possible. Unexpected expenses will happen. Use your emergency fund to cover them, then plan ahead for the next time. Also, think a few months out. Any big events approaching? Birthdays and Christmas can be easier to afford if you spread the cost out. If you save a little ($10 or $20) each month, then you wont be caught needing to pay $100 all at once. Same goes for car repairs or household maintenance. Establish a savings account dedicated to this, and suddenly, emergencies wont be, because you planned for them.

When you get to page three, you'll add up the totals from all three pages and compare them to the Total Household Income that you filled in earlier. Hopefully, the Grand Total will be less. If it isn't, you'll have to cut something. Again, start with the Incidental categories: Recreation, Personal, perhaps Clothing and Restaurants. If possible, don't cut these categories completely. If you don't allow some fun in your budget, you will have fun outside of it and kill the whole thing.

At the same time, it's important to recognize that getting out of debt means sacrificing. This is the point where you need to tell the whiny kid inside of you to go into timeout and let the adult make tough decisions with the ultimate goal (financial peace and freedom for you and your family) always in mind.

Have things that you just can't cut, but know you should? Or things you'd like to get eventually but aren't pressing at the moment? Make a list. We'll deal with them in Step 5.

If, however, your Grand Total is indeed less than your Total Household Income, this is not a license to party. First, make sure that you've filled in everything you should have (all the categories on all 3 pages...), then it's time to do some subtraction. Find out how much extra there is, and add that to the payment of your smallest debt. This extra is known as a "Snowflake" and will help get your Debt Snowball rolling. (We talked about our Debt Snowball back in May.)

Your Grand Total, minus your Total Household Income should equal ZERO. Income = Out go. So, add it up again and make it balance.

Told you the eraser would come in handy.

Thursday, September 1, 2011

Locavore Challenge Day 1

Our last post we talked about the Locavore Challenge put out by NOFA-NY for the month of September. There are any number of different challenges you can take on as part of the month that have to do with what you eat, where you buy it, and what kind of foods you put your money into. Our own personal challenge (along with the challenges we selected on the website) was to see how many foods we could eat that were sourced within 250 miles of home. This isn't something we've given a lot of thought to, though we would say we have been casually locavore since we've been married. In general, our local eating habits have been limited to honey, apples, and meat (read: quarter of beef we purchased last year). This month, we're going to see how many of our regular foods can come from within that 250 mile radius. Here's a look at today. (NB we will not just be posting about foods for the next 30 days, but today is day 1 and we thought it would be a good idea to get the ball rolling.)

Breakfast: Wheat Germ Griddle Cakes from More With Less

More to come about money, food, being locals, et al. In the meantime, visit the NOFA-NY website and sign up!

Breakfast: Wheat Germ Griddle Cakes from More With Less

- Wheat germ purchased from local co-op

- Local eggs and milk

- Local maple syrup and (homemade) maple cream

- Summer squashed from the roadside stand

- Tomatoes from the co-op

- Cucumbers from our friends down the road

More to come about money, food, being locals, et al. In the meantime, visit the NOFA-NY website and sign up!

Thursday, August 25, 2011

Living simply: previews of things to come

This last weekend was really spectacular! After leaving family in North Carolina, we drove north through Virginia to stay with some friends outside of Washington, DC. The plan had been to go to the National Zoo in the morning, but parking costs something like $20 and we didn't have that kind of money in the budget. Instead Ana and our friends' little boy played on the park while Zoë tried to nap, then it was off to DC to see family and meet new friends. We did get to stop in at the Air and Space Museum for a brief visit on Sunday afternoon, but not a whole lot of other sight seeing. Monday was spent entirely in the car taking the fastest roads north. We finally caught our breath Monday night, and work began for Caleb Wednesday morning. Summer is over already?

Starting in September, we're going to be taking part in the 2011 Locavore Challenge sponsored by NOFA-NY. We chose to take on the Meal Sized Challenge and are already gearing up for the month! We feel this is important to our goals and to this blog, because a lot of our life since taking Financial Peace University has been about taking control and being better stewards of what God has given to us. We already do many of these things and have found them cost-effective and our well-being has been positively affected by these choices. As we've said before: it's not about how much you make, it's about how you choose to use it.

Here are some things to be looking for here on Debt Free American Road Trip:

Starting in September, we're going to be taking part in the 2011 Locavore Challenge sponsored by NOFA-NY. We chose to take on the Meal Sized Challenge and are already gearing up for the month! We feel this is important to our goals and to this blog, because a lot of our life since taking Financial Peace University has been about taking control and being better stewards of what God has given to us. We already do many of these things and have found them cost-effective and our well-being has been positively affected by these choices. As we've said before: it's not about how much you make, it's about how you choose to use it.

Here are some things to be looking for here on Debt Free American Road Trip:

- Book reviews on titles including Simply in Season, The World at Your Table (written by a family friend), and In Defense of Food among other articles and books.

- Recipes we've tried using foods sourced within 250 miles from home.

- Menus and financial plans for paying for more local and organic foods.

- Ways that this project has helped us with our financial and personal goals

Happy reading!

Thursday, August 18, 2011

Our Story part 3: Derailed

We'll return to our experience at Financial Peace University during another series of posts. To sum up that experience here, let me just say that it completely changed our lives. We no longer felt afraid and confused, and we had plans to pay off our debt in less than three years. And then our future got derailed.

In November, 2009 Emily and I went to the National Youth Workers Convention in Cincinnati. I came back having been challenged, encouraged, excited, impassioned. This was going to be the year of real change, real excitement in the youth group. I had a beautiful family, a new baby on the way, and a clear vision that took me ten years into the future. By the time February had come, we were staring down the barrel of unemployment.

The hows and whys of our decision to move on from Michigan don't play into this posting. There were a lot factors that led to our packing up, moving out, and heading to my parents' house in North Carolina. The church gave us two wonderful gifts: health insurance to the end of the year and three months of severance pay. The plan we devised from there was straightforward: stop the Total Money Makeover until we got back on our feet. We stockpiled our tax refund in our emergency fund, paid the penalty for breaking our lease early, and hired the least expensive moving company we could find. From there, move into the house my parents had been unable to sell and look for work. I paid for my teacher's certification and started sending out resumes and applications from February to June of that year.

Stopping our Total Money Makeover may have been the most frustrating thing we have had to do since graduating from FPU. We were used to sending in huge payments to our debts every few months, cutting our food spending, and finding new and creative ways to give and bless others with our resources. To have all of this cut off in the midst of our flow was incredibly discouraging. We managed to make our way through that summer making $150/wk at Barnes and Noble, and we managed to keep paying off the car and making our other minimum payments. It's incredible to think that we survived and came out strong on the other side. Next time I'll write about finding a job, moving again, and learning how to live on a very tight budget.

In November, 2009 Emily and I went to the National Youth Workers Convention in Cincinnati. I came back having been challenged, encouraged, excited, impassioned. This was going to be the year of real change, real excitement in the youth group. I had a beautiful family, a new baby on the way, and a clear vision that took me ten years into the future. By the time February had come, we were staring down the barrel of unemployment.

The hows and whys of our decision to move on from Michigan don't play into this posting. There were a lot factors that led to our packing up, moving out, and heading to my parents' house in North Carolina. The church gave us two wonderful gifts: health insurance to the end of the year and three months of severance pay. The plan we devised from there was straightforward: stop the Total Money Makeover until we got back on our feet. We stockpiled our tax refund in our emergency fund, paid the penalty for breaking our lease early, and hired the least expensive moving company we could find. From there, move into the house my parents had been unable to sell and look for work. I paid for my teacher's certification and started sending out resumes and applications from February to June of that year.

Stopping our Total Money Makeover may have been the most frustrating thing we have had to do since graduating from FPU. We were used to sending in huge payments to our debts every few months, cutting our food spending, and finding new and creative ways to give and bless others with our resources. To have all of this cut off in the midst of our flow was incredibly discouraging. We managed to make our way through that summer making $150/wk at Barnes and Noble, and we managed to keep paying off the car and making our other minimum payments. It's incredible to think that we survived and came out strong on the other side. Next time I'll write about finding a job, moving again, and learning how to live on a very tight budget.

Friday, August 12, 2011

Our Story part 2: Deciding to change the future

When I wrote about how we got into the financial mess in which we currently find ourselves, I left it intentionally brief. There's time to discuss the results of our coming to our senses in later posts. I want to talk today about the events that led to our making the decision to start Financial Peace University.

There are few things more demoralizing than overdrawing on your checking account. Really, there's no reason to ever do it; but people do it every day. It felt like no matter how we careful we tried to be, the numbers at the end of the month were always red on the Bank of Evil (aka Bank of America) website. Part of that is because they have this horrible policy of never denying your card no matter what your account looks like, and there's that insidious (possibly illegal) practice of listing your debit card transactions from largest to smallest. As much as I would like to keep verbally abusing them, this is about personal responsibility.

Emily and I tried budgeting for several months. Usually, this was Emily sitting down with Excel or Word and listing expenses and then we would spend the money as though the "budget" didn't actually exist. This vicious cycle repeated itself between November of 2008 and March of 2009 (estimated). It was during this time that our church decided to host Financial Peace University. The promotional material talked about people who saved so many thousand dollars and paid off up to $5000 in debt. We figured we needed to do something to change the status quo. We may not have paid off that much debt in those 13weeks, but we all agree: the best $100 we've ever spent.

There are few things more demoralizing than overdrawing on your checking account. Really, there's no reason to ever do it; but people do it every day. It felt like no matter how we careful we tried to be, the numbers at the end of the month were always red on the Bank of Evil (aka Bank of America) website. Part of that is because they have this horrible policy of never denying your card no matter what your account looks like, and there's that insidious (possibly illegal) practice of listing your debit card transactions from largest to smallest. As much as I would like to keep verbally abusing them, this is about personal responsibility.

Emily and I tried budgeting for several months. Usually, this was Emily sitting down with Excel or Word and listing expenses and then we would spend the money as though the "budget" didn't actually exist. This vicious cycle repeated itself between November of 2008 and March of 2009 (estimated). It was during this time that our church decided to host Financial Peace University. The promotional material talked about people who saved so many thousand dollars and paid off up to $5000 in debt. We figured we needed to do something to change the status quo. We may not have paid off that much debt in those 13weeks, but we all agree: the best $100 we've ever spent.

Wednesday, August 10, 2011

Our Story part 1: How we got into this mess

When we started working on this blog, we wanted to create a place where we could keep ourselves accountable; and hopefully provide encouragement for those of you who read our stories that the future is not as grim as it may appear at times. Coming to the realization that we had to start taking responsibility for our finances took some time, and we have had to constantly reaffirm our commitment to our goals and our future. As we move closer to our being received into the Orthodox Church, I thought it would be appropriate for some financial confession.

If I'm being honest with myself, I financed my way through college and graduate school by reasoning that ten years (the estimated time to repay student loans from the time you graduate) really isn't that long, and I'd have a job that paid well enough to cut that time in half. When I received my bill for $28,000 from Gordon College, I was just thankful that it wasn't six figures like others of my graduating class. Of course, I didn't take into account that my first job out of college would pay me $7.50/hr, nor that I would jump right into graduate school-- taking on another $25,000 in student loan debt. I also had to fix my car ($3000) and buy a new one. (Yes, I bought a new car.) $14,000 later and I was $67,000 in the hole. Then we got married (bringing another $15,000 into the mix), got a well-paying job, and proceeded to blow our money like children! By the time we realized that we were in trouble, the damage had been done: we were in deep debt and struggling to pay our monthly bills.

Looking back on it now, a lot of this could have been avoided if we had been a little more discerning in our choices. For one thing, I definitely wouldn't have hit "accept" on the loan with a 10% interest rate. I probably also would have bought a nice used car with the money I got from selling the old one. Now we're stuck paying for our mistakes, and missing out on a lot of the fun things in life now because we've made a decision to change our family tree and give our family a brighter future.

If I'm being honest with myself, I financed my way through college and graduate school by reasoning that ten years (the estimated time to repay student loans from the time you graduate) really isn't that long, and I'd have a job that paid well enough to cut that time in half. When I received my bill for $28,000 from Gordon College, I was just thankful that it wasn't six figures like others of my graduating class. Of course, I didn't take into account that my first job out of college would pay me $7.50/hr, nor that I would jump right into graduate school-- taking on another $25,000 in student loan debt. I also had to fix my car ($3000) and buy a new one. (Yes, I bought a new car.) $14,000 later and I was $67,000 in the hole. Then we got married (bringing another $15,000 into the mix), got a well-paying job, and proceeded to blow our money like children! By the time we realized that we were in trouble, the damage had been done: we were in deep debt and struggling to pay our monthly bills.

Looking back on it now, a lot of this could have been avoided if we had been a little more discerning in our choices. For one thing, I definitely wouldn't have hit "accept" on the loan with a 10% interest rate. I probably also would have bought a nice used car with the money I got from selling the old one. Now we're stuck paying for our mistakes, and missing out on a lot of the fun things in life now because we've made a decision to change our family tree and give our family a brighter future.

Saturday, August 6, 2011

How to Budget : Step 2

These are the steps we take to do our budget, here we'll deal with Step 2.

- Determine income and pay periods for the month

- Name your Income

- Make it balance

- Allocate your expenses for each week

- Prioritize Irregular Income

Step 2: Name Your Income

Now that you have your total income in front of you, you'll need to determine where to send it. We recommend prioritizing your naming so that you have the basics covered. On a calculator, or a piece of scrap paper if you're arithmetic savvy, subtract each item from your total as you go. This will help you see how far your paycheck can go.

If you run out of money before getting to the end of the list, don't worry, go ahead and finish. We'll deal with the overage in Step 3 and Step 5.

- Charitable giving - we do 10% of total income - whether to a church or a non-profit, giving a portion of your money away not only gives you a warm fuzzy feeling and makes you a better person, but it also will help you relax if money is a point of stress

- Savings: If your savings account/emergency fund is below $1000, try to raise it. (If you can't fill it completely and cover #3, do as much as you can.)

- Four Walls: House, Food, Transportation, Clothing - this includes mortgage/rent, utilities, diapers, fresh veggies, car payment, gas, oil changes, new underwear, all insurance premiums and anything else that you need to function. This does not include: brie, beer, spinners, another purse or that cute baby dress.

- Incidental expenses - includes such things as date night, trip to see grandparents, birthday gifts, a hair cut, and other things which help keep you sane, but are not truly necessary for survival. Remember, getting out of debt is about cutting life style. This is where your lifestyle will be cut.

- Outstanding debt - Make sure to pay the minimum on everything first, then add any remaining income to the debt with the smallest total balance. Try to pay it off completely. When you do, you can add that minimum payment to the minimum of the next smallest debt which will help you pay that one off faster. This is the principal behind the Debt Snowball. Don't worry about which debt has the highest interest rate, just pay things off as fast as possible so you can tell your money where to go instead of wondering where it went.

When we got to the end of this step the first few times we did our budget, it felt like we got a raise. It's amazing how much even a little bit of money can do, when you know what it's doing and why.

We'll cover Step 3 in our next post, in which we'll determine who does get paid and who does not.

Wednesday, August 3, 2011

Guest Post on Relishments.com

We recently had the opportunity to write about eating on a tight budget for Emily's dear friend Emily. (It's weirder than you think, our last names were really similar and we were college roommates.) But anyway, check out our guest post on relishments.com.

Please note, she's been at this blogging thing for a lot longer than we have, so her page is really nice.

Please note, she's been at this blogging thing for a lot longer than we have, so her page is really nice.

How to Budget : Step 1

We began posting the last time about the process of writing our monthly budget. One of the principles we work with through our Total Money Makeover is a written budget at the beginning of every month. Like Dave says, "Every dollar has a name": which means that every penny for the month gets spent on paper before the month begins. It's not always easy, but it's incredibly rewarding; and we usually discover we have more money than we thought. When budget night comes, Caleb uses the Gazelle Budget Software on the Total Money Makeover website and Emily uses Dave's budget forms (found here).

Below are the steps we take to do our budget: (We'll deal with the first step in this post)

Below are the steps we take to do our budget: (We'll deal with the first step in this post)

- Determine income and pay periods for the month

- Name your Income

- Make it balance

- Allocate your expenses for each week

- Prioritize Irregular Income

Supplies:

Step 1: Determine Income and Pay Periods for the Whole Month

- previous month's paychecks and/or projected income statement

- previous month's budget form (if it exists)

- calculator

- Budget forms or legal pad

- pencil with a good eraser

- Computer (if using online software)

Before you can spend your hard earned cash on paper before the month begins, you have to know how much money is available to you. (For those of you with an irregular income, there's a form for that that we will discuss later.) You also need to know when you will be paid so that you can decide what bills and expenses are covered during which week in the month. Emily does the allocated spending sheet at the end of our time crunching the numbers.

We find it easiest to add up the various sources of income and write down the source at the bottom of page 3 of the Dave Ramsey form, but if you're starting from scratch, write it on the first line.

This month, our income looked like this:

School Pay Check 1 + Summer Job Pay Check 1 + School Pay Check 2 + Summer Job Pay Check 2 = Total Income

Our paychecks are currently bimonthly, but they don't come at the same time (i.e. the school pays on every other Friday, the summer job on every other Monday) -- we'll deal with that conundrum in Step 4.

Don't include any income that you aren't actually sure you will be getting. If you work on commission, tips or hourly, budget what you can reasonably expect to receive, not what you hope you'll earn. For example if you always work at least 20 hours a week, but can work as many as 40, budget the 20 in this step. Following this method will help you prioritize your income and especially important if you don't have very much of it.

We'll deal with irregular income in Step 5.

Tips: Make sure you know when you can expect your pay check to be available to you, this may be different from the day you actually get paid if you have direct deposit.

Also, determine whether or not you get paid on specific days of the month, or days of the week. Is it every other Friday or the first and third Fridays? The first Wednesday of the month or the 1st of the month?

Next, we'll go through Step 2, in which ever dollar gets a name and life gets prioritized.

Thursday, July 28, 2011

Budgeting Again

Here we are at the end of another month. July seemed really long this year, especially since we had our Emergency at the end of June which spilled into July. At the lowest point, our Emergency Fund had $1.14 and our checking account had $48. We usually have more of a cushion, but there was an issue with payroll that has since been cleared up.

Let me tell you, being that broke I was so grateful for our budget. I looked at the bank account (gasped and swore a bit) and looked at my check book. Within five minutes, I knew we were ok. All our checks had cleared, and there was nothing hanging out there on the debit card waiting to clear because we use cash for all our incidental purchases (groceries, gas, clothing, etc.). Even though we had less than I would have liked, I knew none of it would go anywhere before we got paid again. I knew that every one of those dollars was named "sinking fund for Caleb's life insurance", which we pay at the end of the year, and would not be leaving the account.

That was our situation when we did our July budget. Now, it's time to do August. We have refilled our emergency fund and Caleb's life insurance fund. Our car now has a rebuilt transmission and a new muffler. We're free and clear to look forward to next month and all it's oncoming craziness.

Usually, we'd just adjust last month, but since August will be so completely different than previous months, we'll be starting from scratch and we'll go through it with you.

There are two forms that we use from Dave Ramsey's My Total Money Makeover site (they're in all of his books too). The first is the Cash Flow Plan (pdf) and the second is the Allocated Spending Form (pdf). Over the next few days we'll walk through how we do our budget so you can see how these forms work in real life.

It'll be way fun. You're welcome.

Let me tell you, being that broke I was so grateful for our budget. I looked at the bank account (gasped and swore a bit) and looked at my check book. Within five minutes, I knew we were ok. All our checks had cleared, and there was nothing hanging out there on the debit card waiting to clear because we use cash for all our incidental purchases (groceries, gas, clothing, etc.). Even though we had less than I would have liked, I knew none of it would go anywhere before we got paid again. I knew that every one of those dollars was named "sinking fund for Caleb's life insurance", which we pay at the end of the year, and would not be leaving the account.

That was our situation when we did our July budget. Now, it's time to do August. We have refilled our emergency fund and Caleb's life insurance fund. Our car now has a rebuilt transmission and a new muffler. We're free and clear to look forward to next month and all it's oncoming craziness.

Usually, we'd just adjust last month, but since August will be so completely different than previous months, we'll be starting from scratch and we'll go through it with you.

There are two forms that we use from Dave Ramsey's My Total Money Makeover site (they're in all of his books too). The first is the Cash Flow Plan (pdf) and the second is the Allocated Spending Form (pdf). Over the next few days we'll walk through how we do our budget so you can see how these forms work in real life.

It'll be way fun. You're welcome.

Sunday, July 24, 2011

Slogging

There's not to much to report as far as our debt paying-off progress or road trip plans. We continue to battle the temptation to do something off budget "just this once" "because we deserve it".

At some point, I think, it gets easier. But we aren't there yet. Right now, we have to stay focused and do what's needed to get it done in the long run. Every day. Little by little. Baby steps.

At some point, I think, it gets easier. But we aren't there yet. Right now, we have to stay focused and do what's needed to get it done in the long run. Every day. Little by little. Baby steps.

Sunday, July 3, 2011

Sometimes, paying off debt really stinks.

Have you ever prayed for patience? Whenever I do, it seems virtually guarenteed that within mere hours something will come along and test my patience to the limit, usually leaving me furious, frustrated and all together impatient.

The same thing seems to happen whenever I make a resolution of any kind, including getting serious about getting out of debt. Not too long ago, I blogged about our Emergency Fund and how we've used it a few times, but it generally seems to cover things.

"Things" in this case does not include a rebuilt transmission, as we discovered last week. No, a transmission generally runs about twice our emergency fund ($1897, to be exact). So, what to do? We were able to squeeze about $100 extra out of our budget for the month, but that still left us about $800 in the hole. To make up the difference, Caleb's dad stepped in and provided. In our July budget, we will be paying him back as soon as our four walls (housing, food, transportation and clothing) are covered. Then, we'll be rebuilding our emergency fund. Even with Caleb working an extra job and nearly doubling our normal income, we won't be able to go back to our snowball until August, unless money drops from the sky.

Financially, I know we'll be fine. Emotionally, I'm pissed off, frustrated, tired and, in moments of weakness, ready to throw in the towel and just be defeatest about the whole thing. It seems like every time we're ready to really get going with paying down the debt some little thing pops up and wont let us do it quite yet. When will it end? When does it get easier?

Well, not yet.

The good news is that we are not going through this alone. God always knows when we're at our most exhausted (physically, emotionally, financially, etc.) and uses that exact moment to remind us of his love and provision. In that vein, two things happened this week. The first was a talk that Dave Ramsey gave at my uncle's church. He sent me the link to the videos. In that video Dave talks about how when the transmission blows (and he uses that example) is a test. This is when the rubber meets the road. If we weren't really committed to being debt free, it would have been really really easy to open a new credit card account to pay for it.

The second moment was at church this week. The gospel reading was, of course, Matthew 6:19-34. Do not be anxious. I know what you need. I'll take care of you. Keep doing what you're supposed to do and let me handle tomorrow.

Well, not yet.

The good news is that we are not going through this alone. God always knows when we're at our most exhausted (physically, emotionally, financially, etc.) and uses that exact moment to remind us of his love and provision. In that vein, two things happened this week. The first was a talk that Dave Ramsey gave at my uncle's church. He sent me the link to the videos. In that video Dave talks about how when the transmission blows (and he uses that example) is a test. This is when the rubber meets the road. If we weren't really committed to being debt free, it would have been really really easy to open a new credit card account to pay for it.

The second moment was at church this week. The gospel reading was, of course, Matthew 6:19-34. Do not be anxious. I know what you need. I'll take care of you. Keep doing what you're supposed to do and let me handle tomorrow.

Thursday, June 23, 2011

Struggles of the process

Having $1000 stashed away just for emergencies is wonderful. You feel secure (mostly) and are able to handle most issues that arise unexpectedly. Then there are the inevitable Murphy moments that come up and clean you out completely. We got visited by one those today. Our "new" car's transmission went *barf* yesterday, and the bill from the mechanic will be upwards of $1700! That's a lot of money and the cheapest we've found.

So back to Baby Step 1. We need to get $1000 back in the bank. Rough month for this to hit. We had just mailed our first Debt Snowball payment to the Horrible Woman (SallieMae). Still...it's all part of the process of getting control of our financial future. This would be so much worse if it weren't for the initial $1000 in the bank! I've had to try to find $2000 before to fix a car, and this time I've only had to scrape together about $500--not bad, all said and done. Baby steps, baby steps, baby steps. I keep reminding myself that it's only a matter of time and things will get better.

So back to Baby Step 1. We need to get $1000 back in the bank. Rough month for this to hit. We had just mailed our first Debt Snowball payment to the Horrible Woman (SallieMae). Still...it's all part of the process of getting control of our financial future. This would be so much worse if it weren't for the initial $1000 in the bank! I've had to try to find $2000 before to fix a car, and this time I've only had to scrape together about $500--not bad, all said and done. Baby steps, baby steps, baby steps. I keep reminding myself that it's only a matter of time and things will get better.

Saturday, June 18, 2011

St Tikhon's Monastery

Possibly one of the better kept "secrets" of the road is "America's Holy Mountain"--St. Tikhon's Monastery and Seminary. Actually the oldest Orthodox Monastery in the United States, unless you happen to be Orthodox, you probably aren't aware that it's even there. And how would you be? It's a good 10 miles from Scranton off of I-84 and (though well signed) is pretty remote in its setting. It is, however, an incredible site and well worth a visit (even if you aren't Orthodox).

The grounds of the monastery are rather small, though there are a couple of lakes and ponds as well as well-paved roads to walk along and enjoy the quiet of the afternoon. The bookstore/cafe are open every day to the public and contain a great collection of books, icons, music, and vestments. The cafe brews Starbucks Coffee, but don't hold that against them. It's only a dollar and was well needed after leaving the house with very little coffee early in the morning! The bookstore is run by monks and seminarians, and the people are truly wonderful: easy to talk with, intelligent, and genuinely friendly.

The highlight of the trip was the museum of Orthodoxy in America containing everything from Alaskan pieces to vestments worn by St Nikolai of Ochrid and the chalice, panagia, and vestments worn by St Innocent of Alaska! It's also a treasure trove of Orthodox icons and family life collected from families of immigrants over thecourse of the last couple of centuries! A truly amazing collection of items with historic and religious significance. Tip: if you want to see the museum, best to call ahead and set up an appointment so that one of the brothers can lead you through.

It was a well-spent two hours on site, and not nearly the time we would have liked. We definitely plan to return again for a longer visit!

|

| Picture courtesy of 9stmaryrd.com |

The grounds of the monastery are rather small, though there are a couple of lakes and ponds as well as well-paved roads to walk along and enjoy the quiet of the afternoon. The bookstore/cafe are open every day to the public and contain a great collection of books, icons, music, and vestments. The cafe brews Starbucks Coffee, but don't hold that against them. It's only a dollar and was well needed after leaving the house with very little coffee early in the morning! The bookstore is run by monks and seminarians, and the people are truly wonderful: easy to talk with, intelligent, and genuinely friendly.

The highlight of the trip was the museum of Orthodoxy in America containing everything from Alaskan pieces to vestments worn by St Nikolai of Ochrid and the chalice, panagia, and vestments worn by St Innocent of Alaska! It's also a treasure trove of Orthodox icons and family life collected from families of immigrants over thecourse of the last couple of centuries! A truly amazing collection of items with historic and religious significance. Tip: if you want to see the museum, best to call ahead and set up an appointment so that one of the brothers can lead you through.

It was a well-spent two hours on site, and not nearly the time we would have liked. We definitely plan to return again for a longer visit!

Skyline Drive

We started off our summer vacation with a mini-road trip. Since we'll be spending the summer in North Carolina, we decided to take our time going down and take Skyline Drive through Northern Virginia, instead of rushing along on the interstate. We really enjoyed the drive and are looking forward to doing it again in a few years, possibly camping along the way as well. There was no camping this time, since trying that with a toddler and a ten-month-old, both of whom love to explore, would be extremely nerve-wracking, if not just plain stupid. But, we did drive the whole park, we stopped for a picnic lunch and wandered the visitor's center. Most enjoyable was the drive itself: slow, scenic and generally relaxing.

However, both of our little ones hit a wall after their afternoon naps (about 3pm), after that driving was nothing but stressful for everyone. No matter how enjoyable the morning had been, the horror of the afternoon erased it. Two screaming, inconsolable children in the midst of rush hour traffic is enough to make us rethink our whole scheme. This translates into an important lesson that we will use on our Great American Road trip: drive in the morning, arrive in the afternoon.

Subscribe to:

Comments (Atom)